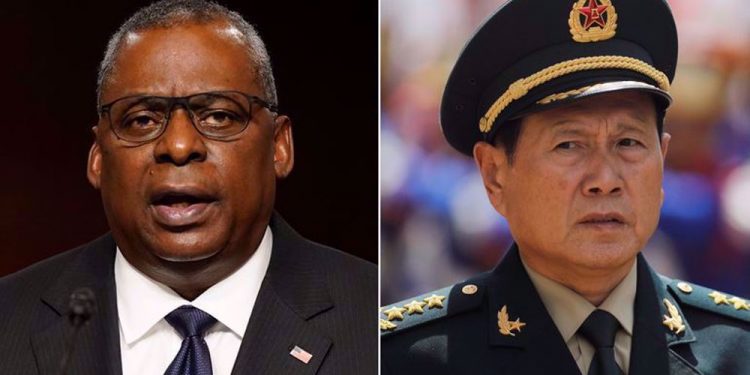

The cryptocurrency market is currently being affected by fears in the international markets about escalating hostilities between the US and China over the planned visit of Nancy Pelosi, the Speaker of US House of Representatives.

The largest digital coin fell as much as 2 percent in the early hours of Tuesday, reading below $23k. Ether lost 3.7 percent at one point, while smaller coins like XRP and Cardano were also declining.

US House Speaker Nancy Pelosi, would be the highest-ranking American politician to visit Taiwan in 25 years, if she eventually visits the Ireland nation on Tuesday as contemplated.

From grave warning from China, it is expected that there will be consequences if the visit goes ahead, considering that the island is claimed by China as part of its territory.

The possible global repercussion from any possible conflict between the US and China, due to the escalating risk, is now possibly pushing investors to sells off what they consider as hazardous assets, includes Bitcoin and other cryptocurrencies.

Bitcoin made a weekend surge toward $25,000 on the road to finishing up its largest monthly gain since October last year before the most recent gyrations.

The earlier rise has reinforced the idea that the worst of this year’s crypto crash is here as Bitcoin is down approximately 51%.

However, speculators appear to view Bitcoin as having a $25,000 ceiling and a $20,000 floor, according to bets made in the options markets.

Based on data gathered by Coinglass, this is due to a large number of active call and put contracts (also known as open interest) at their respective strike prices.

Being riskier assets, Bitcoin and the alternative coins suffered badly. Q2 ended as BTC’s worst trading quarter in over a decade with a massive decline of over 55%. June alone was the asset’s most violent month in over ten years. In it, BTC dumped from $30,000 to a multi-year low of $17,500, and even though it reclaimed some ground by the end, it still closed with a 37% decrease.