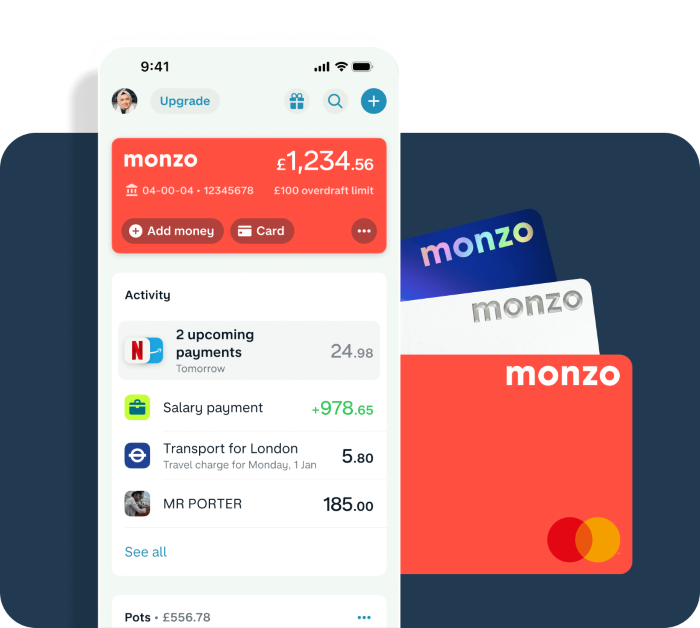

In the ever-evolving landscape of digital banking, Monzo, a UK-based mobile app bank, continues to make waves with its commitment to innovation. Operating exclusively through a mobile app, it has cultivated a growing user base attracted to its user-friendly interface and forward-thinking solutions.

Monzo, the digital bank, has taken a pioneering step in the UK banking sector by unveiling a new “call status” feature within its mobile app.

This innovative tool is designed to protect its customers from falling prey to impersonation scams, a type of fraud that has been on the rise. We look at this in this report.

Quick Background about Monzo: A Banking Disruptor with a Flourishing User Base

Monzo, originally founded in 2015, has emerged as a pioneering force in the realm of digital banking. Its journey began as a fintech startup, but it swiftly evolved into a full-fledged digital bank with a distinctive focus on revolutionizing traditional banking services.

At the heart of Monzo’s appeal is its unwavering commitment to user experience and its continuous efforts to redefine modern banking.

Monzo’s approach to banking is centred around the convenience and accessibility of its services. Operating exclusively through a mobile app, it has cultivated a rapidly growing user base attracted to its user-friendly interface and innovative solutions.

Customers can seamlessly manage their finances, make payments, and access a range of banking services directly from their smartphones.

In the competitive landscape of UK banking, Monzo has managed to stand out. It has consistently received accolades for its innovative approach and customer-centric philosophy.

Monzo was voted the best provider for both individuals and businesses in a survey of thousands of people in Britain.

This recognition reaffirms its status as a leading digital bank in the UK. Moreover, rival digital bank Starling Bank also earned high praise, particularly for its online and mobile banking services for personal accounts.

In a financial environment increasingly dominated by digital solutions, Monzo’s popularity reflects the growing appetite among consumers for convenient, tech-driven banking experiences.

Its reputation as a disruptor in the banking sector has solidified, making it a key player in the evolving landscape of UK banking services.

A Look at Rising Online Frauds and Identity Scams in the UK

The United Kingdom has found itself at the forefront of the digital banking revolution. However, this progress has come hand in hand with a concerning uptick in online frauds and identity scams.

Fraudsters have become increasingly cunning, using sophisticated methods to impersonate trusted entities like banks and utility providers.

These impersonation scams often involve urgent requests for personal and financial information, as well as demands for immediate money transfers.

The consequences of falling victim to such scams can be financially devastating and emotionally distressing.

In 2022, these scams collectively drained more than £177 million from unsuspecting victims, according to UK Finance figures. It’s a growing concern that threatens the financial well-being of individuals and the trust in digital banking systems.

Monzo’s Rising Cases of Forced and Unexplained Customer Account Closures

While Monzo stands out as a digital banking pioneer, it has grappled with a challenging issue: an increasing number of forced and unexplained customer account closures.

While Monzo maintains a strict policy of not initiating unscheduled phone calls to its customers, fraudulent actors have exploited this uncertainty. They have posed as Monzo representatives, causing confusion and concern among users.

These unauthorized account closures have not only left customers puzzled but also raised questions about the security of digital banking services. Customers have expressed frustration over sudden and unexplained account closures, leading to a loss of access to their funds and the inconvenience of finding alternative banking solutions.

The Innovative “Call Status” Tool and What It Brings to the Table

Monzo’s response to these challenges is the introduction of the groundbreaking “Call Status” tool within its mobile app. This innovative feature empowers Monzo users to verify incoming calls instantly.

When a legitimate call from Monzo is received, it is marked as “verified.” Conversely, if it’s an attempted scam, the tool issues a clear warning to the user to disconnect the call and promptly report the incident.

This proactive approach aims to provide customers with the means to identify and thwart fraud attempts in real-time. It adds an extra layer of security, giving users greater confidence in their banking transactions.

Monzo’s commitment to protecting its customers from fraud is underscored by this development, as it strives to ensure that users have a secure and seamless banking experience.

Looking Ahead: Predicting the Trend

As the battle against online fraud and impersonation scams intensifies, innovative solutions like Monzo’s “Call Status” tool are expected to become integral in safeguarding individuals and businesses from falling victim to such scams.

This move aligns with Monzo’s commitment to prioritizing customer protection in the ever-evolving landscape of online fraud.

Digital banks, with their customer-centric approach and technological advancements, are likely to continue leading the way in providing secure and seamless financial services in the digital age.

The banking industry can anticipate further integration of cutting-edge security features to counter the evolving tactics of cybercriminals, ensuring that customers can bank with confidence in the digital realm.

For any enquiries please, email our editorial team at [email protected]. If you liked this story, kindly sign up for Clariform Newsletter, a handpicked selection of stories that helps you clarify things that matter and gives you clear signals about your world, delivered directly to your inbox.

Please subscribe to our YouTube channel, and join thousands of Clariform on Facebook, Twitter and Instagram.